What Do I Need To Register A Nonprofit Organization

Complying with bylaws, attaining and maintaining tax-exempt status, managing a Board of Directors… Starting and registering a nonprofit can seem like a complicated and daunting task. Nevertheless, equipped with the correct data and a resilient approach, the procedure is easier than it seems.

This is not to say that establishing a nonprofit is without its challenges. Starting a nonprofit requires strategy, planning, commitment, and organizational skills. Not to mention, years of hard work and strong willpower are required to sustain a successful nonprofit in the years to come…

When establishing a new nonprofit, the kickoff pace for most organizations is to apply for the official 501 (c)(3) status.

What is a 501(c)(3)?

Department 501(c)(iii) is the role of the Usa Internal Revenue Lawmaking that allows for federal tax exemption of nonprofit organizations. A 501(c)(iii) organization is a corporation, trust, unincorporated clan, or other types of organization exempt from federal income tax under section 501(c)(three) of Title 26 of the United states Code.

Organizations must be considered "charitable" by the IRS to receive a 501(c)(3) classification. According to the IRS, a charitable arrangement is ane that has been established for the below purposes :

- Religious

- Charitable

- Scientific

- Testing for Public Rubber

- Literary

- Educational

- Fostering national or international amateur sports, and

- Prevention of cruelty to animals and children

Organizations that likewise help the poor and underprivileged, aid erect or maintain public buildings or national or state monuments, promote civil rights, and gainsay juvenile delinquency and urban decay can also be considered nonprofit organizations.

There are many reasons why organizations choose to apply for the official 501(c)(three) status.

three Master Types of 501(c)(3) Organizations

i. Public charity

A public charity, identified by the Internal Acquirement Service (IRS) as "not a private foundation", must obtain at least ane/three of its donated revenue from a fairly wide base of operations of public back up, i.eastward directly or indirectly, from the general public or from the government. Public support must be fairly broad, not limited to a few individuals or families, it can be from individuals, companies, and/or other public charities.

Public charities are divers in the Internal Revenue Code nether sections 509(a)(0) through 509(a)(4).

Donations to public charities can be revenue enhancement-deductible to the individual donor up to 60% of the donor's income. In add-on, public charities must maintain a governing body that is mostly made up of independent, unrelated individuals.

Also read: Everything You Need to Know well-nigh 509(a)(i) Public Charities

2. Private foundation

A private foundation, sometimes called a non-operating foundation, receives nearly of its income from investments and endowments. This income is used to support the work of public charities through grants, rather than beingness disbursed straight for charitable activities. They are not required to be publicly supported, so revenue may come from a relatively small number of donors, even unmarried individuals or families.

Private foundations are defined in the Internal Acquirement Code under section 509(a) as 501(c)(3) organizations, which practise non authorize as public charities.

Donations to private foundations can be tax-deductible to the private donor up to thirty% of the donor's income. The assistants of a individual establishment can exist considerably more firmly held than in a Public Charity.

three. Private operating foundation

In general, a private operating foundation is a private foundation that devotes most of its resources to the active conduct of its exempt activities.

These associations frequently maintain agile programs like open charities however they may have traits, (for example, close assistants) like an institution. Thus, private working foundations are regularly viewed as half-breeds. The majority of the income must go to the comport of the program.

A private operating foundation is any private foundation that spends in any consequence 85 percentage of its balanced net gain or its base speculation render, whichever is less, straightforwardly for the bear of exempt activities.

On meridian of that, the foundation has to encounter one of the post-obit tests:-

- the assets test

- the endowment test

- the back up exam

Too, Contributions to private operating foundations as described in Internal Revenue Code(IRS) section 4942(j)(3) are deductible by the donors to the extent of fifty pct of the donor's adjusted gross income.

Here's a short video tutorial on How to Start a 501(c)(iii) Nonprofit Organisation in ten Steps:

nine Footstep Procedure to Start a 501(C)(3) Organisation

- Stride-1: Get clear on your purpose

- Footstep-2: Deciding the blazon of nonprofit

- Stride-3: Name your nonprofit

- Footstep-iv: Form a Lath

- Stride-5: Permit's write the Bylaws

- Step-half dozen: File your incorporation paperwork

- Pace-7: File for 501(c)(3) revenue enhancement-exemption

- Step-8: Ensure ongoing compliance

- Step-9: Get Donations

To help you move through the motions of establishing a nonprofit, we've detailed out a guide below – with a special focus on how to beginning a 501(c)(3) nonprofit system.

Step 1: Get articulate on your purpose

At commencement glance, this might not seem like an essential task when discussing the practicalities of registering a nonprofit. Notwithstanding, getting clear on your purpose is essential.

A clear purpose motivates staff and volunteers, attracts donors and supporters, and helps build a positive image amongst the general public.

One time yous're able to clearly and succinctly communicate your purpose, every subsequent stride will exist simpler – particularly Step 2.

To go clear on the purpose of your organization, it helps to ask yourself the bones investigative questions: Who, What, Where, When, Why, and How:

- Who is information technology that my organization volition bear upon, who are our intended beneficiaries? Who's going to administrate our services? Who are the stakeholders that will help support our mission? Who are my Lath members and potential staff and volunteers?

- What is the mission of my organization? Identify the "problem" you lot're trying to solve. What values will drive my arrangement'due south action?

- Where will we attain our mission, where will the activities accept identify? Is it a local initiative, a land or regional project, or national/international in scope?

- Why am I starting this nonprofit?

- How will I accomplish my mission? How will we raise funding for operations?

Once you accept the answers to these questions, you lot can begin to flesh out a articulate mission argument and a one to three-year plan of action for your organization.

Pro tip: Don't rush the procedure. Spending some time now to get clear on your purpose will pay off after. Reflect on the information you lot get together, write more one typhoon, and gather feedback from key stakeholders.

Step 2: Determine what blazon of nonprofit you desire to establish

If you lot've completed pace i, this step should be relatively piece of cake. Based on your nonprofit's purpose, make up one's mind which type of nonprofit you desire to register as (eastward.g. arts, charities, educational activity, politics, religion, inquiry).

You must fall into one of these 8 broad categories in order to apply for revenue enhancement exemption:

- Charitable (including poverty relief, combating discrimination, advancing education, etc.)

- Religious

- Educational

- Testing for public safety

- Literary

- Youth/amateur sports contest

- Scientific

- Cruelty prevention for children and animals.

In that location are 29 types of nonprofit organizations that tin file for tax-exemption under section 501(c) of the Internal Revenue Lawmaking. The most common of these is the 501(c)(3), which includes all charitable, religious, scientific, and literary organizations. Other types of taxation-exempt nonprofits fall under different 501(c) codes such as:

- Fraternities: 501(c)(eight)

- Social and Recreational Clubs: 501(c)(7)

- Merchandise associations and Chambers of Commerce: 501(c)(half dozen)

- Agriculture or Horticulture organizations: 501(c)(5)

- Social Welfare Groups:- 501(c)(iv)

If your nonprofit identifies with one of the above or another type of system, you tin can view the whole list hither.

If you lot are not sure near 501(c)(3) or 501(c)(four), don't forget to bank check out our in-depth guide on the same. You can also read this in-depth checklist while starting your nonprofit organization.

Pro tip: Plan for startup costs for your nonprofit. For example, depending on your state, incorporation tin toll you from $8 (Kentucky) to $270 (Maryland). If y'all intend to start a 501(c)(iii), await to pay between 275$ if you make full out the simpler Grade 1023-EZ and $600 for the more complex Form 1023 (which has more item).

Footstep 3: Proper name your nonprofit

Every state in the United States has different rules and regulations when it comes to establishing a nonprofit. All the same, it's rubber to say you should select a proper name that's unique and somehow related to the main activities of your nonprofit.

This decision will fix the tone and influence your nonprofit's make for years to come. So it's smart to take some time to think through this determination.

Make sure your nonprofit'due south name is easy to say and remember. Apply descriptive words, but endeavour non to overdo it or get in besides long. Don't employ technical/industry-specific jargon. Abbreviations are good if you use them well.

If y'all're stuck on the name:

Try brainstorming with your team or your friends and acquaintances. Run into which names sound more inspiring or which ones are more memorable. Remind yourself of what your nonprofit's mission is, what your main activities are, who your members are, or even where you're located. It might be a good idea to cheque the availability of spider web domains since that may bear on the name you decide on.

If there's a quality domain proper noun bachelor for purchase, we advise buying it correct away – even if yous're not launching a website presently.

Many states require that nonprofits accept a corporate designator, such as Incorporated, Corporation, Company, Express, or their abbreviations (Inc., Corp., Co., and Ltd respectively). Check your state's incorporation web folio to meet if a corporate designator is required for your nonprofit.

When you have selected your proper name, you need to check with your Secretary of State to see if it is bachelor and the U.S. Department of Commerce website to be sure the name yous desire is non trademarked.

Pro tip: Your state'southward corporation's office can tell yous how to notice out whether your proposed proper noun is available for your use. For a small fee, you can ordinarily reserve the proper noun for a short period of fourth dimension until you file your articles of incorporation.

Footstep 4: Form a Board

Forming a Lath earlier incorporating is generally a good thought. Some states require that you list the names of your Board members in your incorporation documents. Even if your state doesn't require this, recruiting a Board prior to incorporating is helpful.

Your Board can help you with the incorporation and the residual of the sometimes challenging procedure of establishing a 501c3. Hiring the correct Board is essential to the success of your nonprofit.

Who the "right" Board members are will depend on your nonprofit. However, whatever the size or the purpose of your nonprofit – information technology's essential to hire Board members who are dependable, committed, and aligned to your mission and values.

Some other of import bespeak, every bit The Nonprofit Answer Guide mentions, is your Board should be made up of individuals who have expertise and resources in unlike areas.

A good rule of pollex when recruiting is:

- I-3rd from individuals who have access to financial resources or soliciting donations.

- One-third from individuals with direction expertise in areas of financial, marketing, legal and the like.

- And i-third from individuals connected at the community level, with expertise in your service field.

Take fourth dimension to define their roles and task descriptions before starting with the recruitment.

It might also be helpful to create some onboarding files or an orientation guide for your new Board members. Y'all could as well create a welcome upshot where anybody could get to know each other.

Here's a detailed guide on How to Hire a Bang-up Nonprofit Executive Director

Footstep 5: Write upwards your bylaws

The bylaws contain the operating rules and provide a framework for your management procedures. They are the tools of internal accountability and they outline the inner workings of your nonprofit.

The power to adopt, amend or repeal bylaws is vested in the Board of Directors. This is unless otherwise provided in the articles of incorporation or in the bylaws.

Bylaws contain the rules and procedures for things like holding meetings, electing directors, appointing officers, and taking care of other formalities.

Note:

An organisation that is exempt from federal income tax, as described in Internal Revenue Code 501(c)(3), is required to written report changes to its bylaws and other governing documents annually to the IRS on the arrangement's IRS Form 990 – which is part of ensuring ongoing compliance.

Experience gratuitous to look up bylaws templates online. However, note that not all templates contain the required elements to obtain tax-exempt status. In order to obtain the 501(c)(iii) condition, yous must include language in your articles of incorporation specifically stating that:

- The corporation's activities will be limited to the purposes gear up out in section 501(c)(iii) of the Internal Acquirement Code.

- The organization will non engage in political or legislative activities prohibited nether section 501(c)(three).

- Upon dissolution of the corporation, whatever remaining assets will exist distributed to some other nonprofit, authorities agency, or for another public purpose.

SeeIRS Publication 557 for more detailed guidance andsample language.

Contact your state role, (commonly the Secretary of State) that oversees incorporation and ask for a template for your bylaws that yous tin use.

Step 6: Fix and file your incorporation paperwork

Having chosen a name for your nonprofit and appointed a Lath of Directors, completing and filing your incorporation paperwork should be unproblematic.

Within your incorporation paperwork, you will be officially declaring your arrangement'due south proper name, location, purpose, the initial Board of Directors, and more.

You must file "articles of incorporation" with your land'due south corporate filing part. Experts recommend that you incorporate in the land where you volition conduct your nonprofit'due south programs or services.

If you desire to incorporate into another land, you would need to register and apply for separate tax exemptions in each country in which you deport activities.

Filings and fees will vary by land. Incorporating a nonprofit does not make it 501(c)(3) exempt. The IRS requires you to include specific language in your articles of incorporation for those intending to utilise for federal tax-exempt status.

After completing your paperwork, you lot will be ready to send them to your state filing office (in most cases, this is your secretarial assistant of state.) The requirements will vary from state to state. Some may want you to submit your manufactures electronically, others may ask for multiple copies sent via mail, etc. Later on filing your articles, many states as well require you to publish a notice of incorporation with your local paper.

Annotation:

Obtain a federal employer identification number (EIN) prior to applying for 501(c)(iii) tax exemption, even if you don't accept employees. You lot tin can do this chop-chop and easily. For information on how to use for an EIN, including information about applying online, visit the IRS website at www.irs.gov .

EIN will be used to track your system's financial activity and brand it possible to open a concern bank account and to hire paid employees. Pretty much every major transaction your nonprofit engages in volition crave an EIN.

When the state approves your articles of incorporation (sometimes this needs to be done earlier), you should organize your first official lath coming together. The chair of the meeting should report to the Board that the country has canonical the articles. At this point, the board needs to brand the Articles of Incorporation part of the official tape. This coming together is usually referred to equally the "organizational meeting" of the system. The minutes of this coming together is simply a formal record of the proceedings and actions taken, such as setting an accounting period and tax year, approving the issuance of memberships, authorizing and establishing the Lath and other committees, approving the bylaws, approving the opening of a corporate bank account, and more.

Stride 7: File for 501(c)(3) tax-exempt status

You apply for exempt condition with the Internal Revenue Service (IRS) for recognition of tax exemption by filing IRS Course 1023. To get the most out of your tax-exempt condition, file your Form 1023 within 27 months of the date you file your nonprofit manufactures of incorporation.

Be aware, the user fee will be $275 or $600, depending on your awarding method. You must annals an business relationship at pay.gov and pay a registration fee with a credit or debit menu. Information technology also tin can take 3-12 months for the IRS to return its decision, depending on how many questions the IRS has about your application. That's why many experts advise starting with this procedure as soon every bit possible.

Form 1023 itself is upwardly to 28 pages long. With the required attachments, schedules, and other materials that may exist necessary, it is not uncommon for these submissions to the IRS to be up to 100 pages. Think of Form 1023 as an audit of proposed (and/or previous) activity and a thorough examination of your nonprofit's governing structure, purpose, and planned programs. The IRS is looking to make sure that the organization is formed for exclusively 501(c)(3) purposes and that its programs are designed to fulfill these stated purposes. In addition, the IRS is looking closely for conflicts-of-interest and the potential for benefit to insiders, both possible grounds for denial.

It is also possible that you can use a shorter application form (1023-EZ):

- Form 1023: The traditional 26-folio application that is used by larger nonprofits

- Grade 1023-EZ: A condensed 3-folio application that can be used past organizations with gross receipts of less than $fifty,000 and less than $250,000 in assets

Cheque the IRS website and instructions to the grade which include an Eligibility Worksheet y'all must complete to determine if your nonprofit meets the requirements for using the shorter streamlined class.

You must likewise include your nonprofit articles of incorporation and your bylaws with this application.

So, before you starting time filling out class 1023, be certain you lot accept:

- Filed your manufactures of incorporation

- Prepared your bylaws

- Held your commencement nonprofit meeting

The IRS is going to enquire for some specific details to be documented in your application. So exist ready to spend a few days filling out this grade and gathering your resources. Your articles of incorporation and/or your bylaws are going to have to include:

- a statement of your exempt purpose(s), (such as charitable, religious, educational, and/or scientific purposes)

- a dissolution clause

- a disharmonize of interest clause

Also, set up to requite detailed answers near and/or include:

i. Bones information

This includes the name of your nonprofit corporation, contact information, and when you filed your articles of incorporation.

2. A re-create of your manufactures of incorporation and your bylaws added to the awarding form.

3. Clauses as follows:

- a clause stating that your corporation was formed for a recognized 501(c)(3) taxation-exempt purpose (e.g., charitable, religious, scientific, literary, and/or educational), and

- a clause stating that whatsoever assets of the nonprofit that remain afterwards the entity dissolves will be distributed to some other 501(c)(3) tax-exempt nonprofit — or to a federal, country, or local government for a public purpose.

4. A detailed, narrative description of all of your organization'due south activities.

Include a clarification of past, present, and future activities – in their order of importance.

5. Data about all proposed bounty to, and financial arrangements with:

- initial directors

- initial officers (such as the president, chief executive officer, vice president, secretary, treasurer, chief financial officer, or any other officeholder in your system)

- trustees

- the v top-paid employees who will earn more than than $50,000 per yr, and

- the five acme-paid independent contractors who will earn more than $fifty,000 per year

half dozen. A statement of revenues and expenses and a remainder sheet.

*The IRS says that yous should wait to hear from them within 180 days later submitting your application. The IRS goes over your application thoroughly, and if the information is incomplete, the agency may have to contact y'all. This may considerably boring downward the process, which is why it'due south crucial to exist equally prepared as possible before submitting the application.

Note: You might want to hire a lawyer who will aid you with this process. Alternatively, you lot could work with ane of the companies that assist in this expanse, such every bit Nolo.

Pro tip: forty states also require Charitable Solicitations Registration which is commonly administered through the Attorney General's part, though not ever. About states crave registration prior to soliciting donations. Furthermore, while most states recognize the federal 501(c)(three) status as valid for state corporate taxation exemption – California and Texas are big exceptions. They both require their ain application process for charity status in their state.

Stride 8: Ensure ongoing compliance

Once you lot've obtained the 501(c)(three) status, you do not need to file whatever kind of document to renew the awarding. In other words, there is no expiration date on a 501(c)(3) organization. However, there are other deportment that need to be taken to maintain tax-exempt status.

Once the state approves everything, you lot should prepare for annual reporting requirements.

In about cases, an exempt organization must file some version of Form 990 with the IRS, depending on its financial activity. Course 990 shows your finances, activities, governance processes, directors, and fundamental staff, and it is open to public inspection.

Keep adequate accounting records of income, expenses, assets, and liabilities. Yous besides demand to keep advisable records for employees, such as payroll records and payment of withholding taxes, workers' compensation, unemployment taxes, etc. If you hire any contained contractors, you demand to keep copies of any Miscellaneous Income (Course 1099-MISC) documents that are provided to them.

States accept their ain reporting and renewal requirements likewise. Therefore, consider tracking your organization's finances and activities throughout the year. This volition assist the reporting happen smoothly.

Should you lot wish to change your name or address in the future, the IRS mandates that an exempt organisation must report the name, address, and structural and operational changes. When an system files an annual return (such as form 990 or 990-EZ), it must study the changes on its return. If your arrangement needs to report a change of name, see Change of Proper name- Exempt Organizations. If you lot need to report a change of address, see Change of Address – Exempt Organizations. The EO Determinations Part tin can issue an affirmation alphabetic character showing an organization's new proper noun and/or address and affirming the section of the Internal Acquirement Code.

Recommendations:

Many recommend keeping a corporate tape volume where you keep all critical documents (including registration papers, licenses, and permits, meeting minutes, etc.) to ensure you lot're well-organized and fully compliant.

Furthermore, most experts recommend that you do not fundraise until you've received yourletter of determination from the IRS stating that you are now tax-exempt.

If you receive a proposed denial of tax-exempt status and you wish to appeal, consider seeing a lawyer with experience of working with nonprofits.

Pro tip: Check with your state department of consumer diplomacy (or like country licensing agency) for information concerning state licensing requirements. For case, if you sell annihilation to consumers, y'all'll need a sales tax permit, and your activities may crave a zoning permit.

Step ix: Get Donations

Every bit a 501c3, donors to your organization can now receive tax deductions for their gifts. Nonprofits have several fundraising options, including solicitation letters and events, but online giving is apace becoming the almost popular and affordable alternative.

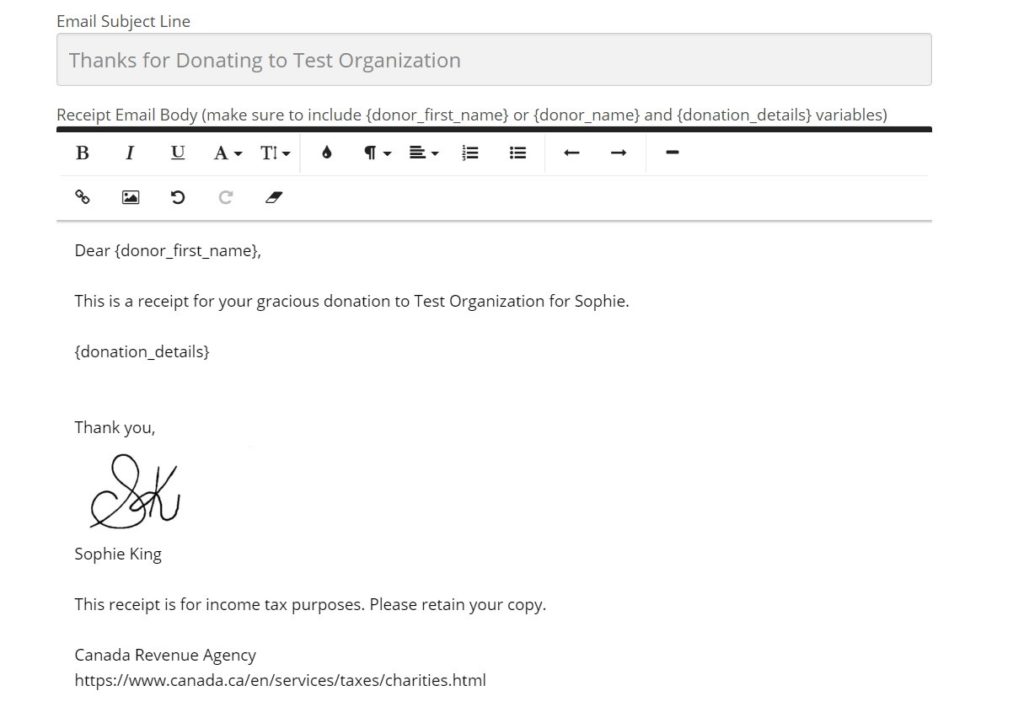

The popularity of online giving is growing, and nonprofits take several options to choose from to collect these donations. Donorbox is one of the easiest and most affordable choices for nonprofits to collect online donations.

For a pocket-sized 1.5% processing fee on donations and no contracts, Donorbox offers nonprofits custom donation forms, donor management programs, 3rd-party integration with your electric current website apps, and more. Below is a list of why Donorbox stands out from the competition.

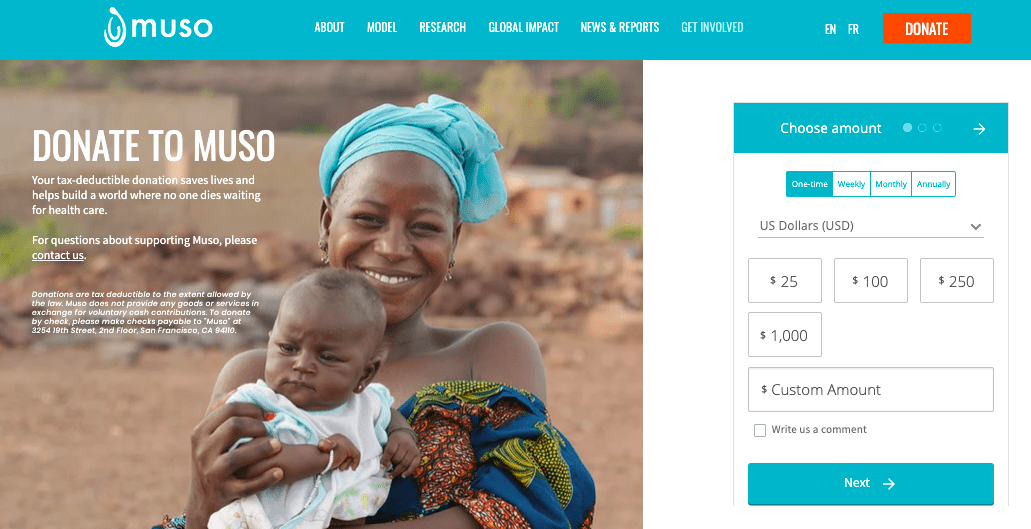

Recurring donations

Recurring donations are a fantastic revenue source for nonprofits. These funds can be depended on and included in your almanac upkeep. Donors dear the convenience of recurring donations because they can regularly back up their favorite organizations without needing to think virtually it. Donorbox gives nonprofits the chance to collect weekly, monthly, quarterly, and annual recurring donations. Muso is a great example for you.

Corporate matching with Double the Donation

Donorbox has partnered with Double the Donation to give nonprofits an affordable alternative for company gift matching. Nonprofits tin offer their donors an easier fashion to find out if their companies offer matching gifts. Integrate Double the Donation on your website and lookout man your revenue increase.

Crowdfunding

Donors are raising funds through crowdfunding for their birthdays and to help people in demand. Nonprofits are hoping to spring on the crowdfunding bandwagon. Donorbox allows nonprofits to create crowdfunding campaigns, ship updates to donors, and share successes online. With these customized campaigns, nonprofits can encourage donors to get involved and share their stories with a new audience. Here's an example –

Text-to-give

Text-to-give donations are chop-chop condign a favorite of younger donors and nonprofits. Donorbox gives nonprofits an like shooting fish in a barrel fashion to collect donations using donor smartphones. Local nonprofits, churches, and politicians have all establish success with these campaigns.

Past sending your donors a text that contains your campaign ID and a link to your donation page, donors tin can make a one-time or recurring donation within minutes. Take advantage of how easy this is and add a text-to-give entrada to your next outcome.

Get Started With Donorbox

What are the benefits of having a 501(c)(3)?

In that location are numerous perks of being taxation-exempt under Section 501(c)(3).

- Tax-exempt status: Exemption from federal and/or state corporate income taxes;

- Deductibility of Donations: Your individual and corporate donors volition be able to deduct their donations from their personal and corporate taxes. Your organization can acknowledge and thank its donors by providing taxation deduction receipts for cash and non-cash donations.

- Express Liability Protection: Nonprofit corporations provide their founders, officers, and directors with protection against personal liability for the activities of the nonprofit.

- Possible exemption from state sales and holding taxes (varies by country)

- Exemption from Federal unemployment revenue enhancement: Potentially college thresholds before incurring federal and/or state unemployment tax liabilities

- Grant eligibility: Existence eligible for grants on federal, state, and local levels. An organization with 501(c)(iii) status can likewise do good from available individual and government grants.

- Discount postage rates and special nonprofit mailing privileges.

- Discounts on publicity: Free or discounted rates for announcements and press releases from nonprofit organizations.

- Online apps at discounted rates: As a registered nonprofit, you can qualify for discounts on many online applications. Hither's a detailed listing of online apps that provides deep discounts to nonprofits.

- Public legitimacy of IRS recognition: Being recognized by the IRS as a 501c3 will make your organization more than official and credible in the eyes of the public and other entities.

- Permanent existence: An organization with a 501(c)(3) status continues to be fifty-fifty afterward the death of its founder(south). The moment your organization achieves 501(c)(3) condition, it is permanent. You'll never have to renew it.

Other perks:

Certain businesses and stores offer discounts to nonprofits and their employees. Some publications also offer nonprofits advertising discounts. Many other businesses and stores readily offer nonprofits and their staff discounts if they're able to nowadays a copy of their 501(c)(iii) status document issued by the IRS.

Registering 501(c)(iii)Nonprofit – FAQs

ane. How much does it cost to be a 501c3?

That depends on which IRS grade you use to file, and you accept 2 options.

- IRS Grade 1023-EZ. The user fee for Form 1023-EZ is $275.

- IRS Form 1023 – IRS Form 1023 is the traditional application method that many new organizations must file with the IRS to obtain their 501c3 tax-exempt condition. The user fee for Form 1023 is $600.

The user fees must be paid through Pay.gov when the application is filed.

In that location is besides the cost of hiring an experienced advisor or professional to prepare your 501c3 application Learn in detail about the cost of filing for 501c3 hither.

two. How long does information technology take for a 501c3 to be approved?

Typically, IRS 501(c)(3) approval takes between ii and 12 months, inclusive of likely written follow-upwardly questions. Sometimes it takes a niggling less; sometimes a niggling more.

Filers of Form 1023-EZ experience a shorter time frame due to the streamlined process of e-filing.

One of the primary reasons for the long review menstruation is the corporeality of fourth dimension it takes for a particular case to be assigned to a review agent. It tin can also depend on the time of year, the type and classification of the nonprofit, and the complication of the application itself.

The expedited review tin be requested if a new organization is existence formed to provide immediate disaster relief or if a promised grant is substantial relative to the organization'southward budget and the grant has a divers expiration engagement. However, there is no guarantee the IRS will grant expedited review requests.

3. Tin can you exist a nonprofit without 501c3?

There are breezy nonprofits — those without formal recognition from the IRS — and it is entirely permissible for them to remain that style. However, without official IRS 501(c)(iii) tax-exempt status, the group is not tax-exempt, and people giving it cannot deduct the amount from their taxes.

Typically, very pocket-sized nonprofits with almanac gross receipts nether $5,000, and churches and integrated auxiliaries of churches and conventions or associations of churches operate without 501(c)(3) status. Donations to these organizations are tax-deductible even though the nonprofit does not hold the tax-exempt status.

4. Practise you have to exist a 501c3 to get grants?

Grantmakers typically fund organizations that qualify for public charity condition under Section 501(c)(3) of the Internal Revenue Code. There are few grants that are offered to organizations without a 501c3 designation- but they are few. Nonprofits can apply for fiscal sponsorship, a formal arrangement in which a 501(c)(three) public charity sponsors a project that may lack exempt status. This enables the project to seek grants and solicit taxation-deductible donations nether your sponsor's exempt status.

5. Can I donate to my own 501c3?

Yes, you can donate to your ain 501(c)(3) arrangement. You can make a tax-deductible donation to whatsoever 501(c)(3) charity, regardless of your affiliation with it. It is non technically your own charity every bit charitable organizations take no owners. However, money donated to charity must exist used for charitable purposes.

You must make sure that the system gives yous a signed receipt for the donation. That indicates what was donated, the value of the donation, and states that no appurtenances or services were received in exchange for the donation.

6. Does a 501c3 pay capital gains revenue enhancement?

Organizations nether Department 501(c)(3) of the IRC are generally exempt from well-nigh forms of federal income tax, which includes income and capital gains tax on stock dividends and gains on sales. As long equally the 501(c)(3) corporation maintains its eligibility equally a taxation-exempt organization, information technology will not have to pay tax on any profits.

7. Does a 501c3 pay property tax?

Properties owned by charitable nonprofits used for a tax-exempt purpose are exempt from property taxes nether land law. If the belongings or any portion of it is not used to promote the nonprofit group's mission, the group tin be liable for holding taxes. For instance, if the group owns a belongings, but leases function of that property to a for-profit concern. Then the grouping is liable for holding taxes on the leased portion of the property.

8. What are the 501c3 requirements for a board of directors?

The Board of Directors is the governing body of a 501C3 nonprofit, responsible for overseeing the organization's activities. The board is required to ensure that the arrangement is legally compliant and is existence run in the best possible way. In a 501c3 organization, the founders may serve on the company'due south board of directors. Certain states require a 501c3 organization to select at least iii people to serve on the system's board of directors. And, at least one director in the organization is responsible for making strategic and financial decisions for the organization.

9. How to check 501c3 status?

Yous can cheque the IRS'southward progress on applications on the IRS website. In one case an agent is assigned for your application, your application review process volition begin. You can check the status of your 501c3 application by contacting the IRS Exempt Organization Customer Business relationship Services at (877) 829-5500. You will need to provide taxation identification and the mailing address of the organization. The IRS just provides data regarding the status of your 501(C)(3) application to an identified officer of the organization.

x. Can 501c3 founders collect a salary?

Equally a 501c3 founder, you can pay yourself a reasonable compensation for your actual services in the nonprofit. The IRS examines reasonableness on the basis of comparable salaries in other comparable nonprofit organizations. You must exist careful to pay yourself reasonable compensation and in order to avoid whatsoever possible claim for excess taxes-benefits from existence paid "too much". The salary should exist within reasonable limits based on the number of hours worked, the overall budget of the organisation, the required level of education, and bounty averages in your area.

eleven. Are 501c3 Organizations tax-exempt?

Yes, All 501c3 Organizations are exempted from federal and/or state corporate income taxes. Although not all activities are tax exempt. Activities that are not related to a nonprofit'southward core mission or purpose are taxable. This tin be whatever activity/business to support a nonprofit's income. Typically, these are categorized as unrelated business concern activities.

Conclusion

Without a doubtfulness, the process of establishing a nonprofit is challenging.

It's advisable that you consult with local expertise (either an attorney, accountant, or someone familiar with the tax-exempt police and how nonprofit organizations operate in your land) to ensure that your new nonprofit complies with country and federal laws and requirements.

An ounce of prevention is worth a pound of cure, and the all-time time to gear up your nonprofit upwards for success is at the very showtime.

Hurdles and obstacles should not discourage you lot. Remember why you lot're doing what you're doing. Come back to your mission and your beneficiaries whenever the process becomes a little bit too much.

We promise this article helped you lot begin to empathise the process of incorporating and acquiring the nonprofit tax-exempt condition.

We also have defended articles for starting a nonprofit in unlike states in the US, including Texas, Minnesota, Oregon, Arizona, Illinois, and more. Bank check out our nonprofit blog to read them and other nonprofit tips and resources.

Note: By sharing this information we practise non intend to provide legal, tax, or bookkeeping communication, or to address specific state of affairs south. The above article is intended to provide generalized financial and legal data designed to brainwash a wide segment of the public. Delight consult with your legal or tax advisor to supplement and verify what you larn here.

What Do I Need To Register A Nonprofit Organization,

Source: https://donorbox.org/nonprofit-blog/how-to-start-a-501c3

Posted by: millerandrom.blogspot.com

0 Response to "What Do I Need To Register A Nonprofit Organization"

Post a Comment